- Joint VA loans allow non-military borrowers to share a VA loan with an eligible Veteran.

- A down payment may be required for non-military borrowers.

For many military members, the dream of homeownership often comes with personal relationships and financial strategies outside the military community. It's not uncommon for a service member to consider buying a home with a non-military individual, whether it’s a family member, friend or life partner.

A joint VA loan allows you to enjoy the benefits of a VA loan as long as one of the borrowers meets the eligibility requirements.

What is a Joint VA Loan?

A joint VA loan refers to a mortgage loan backed by the U.S. Department of Veterans Affairs (VA) where at least one of the borrowers is eligible for a VA loan. Two or more individuals may apply for a VA joint loan together, and all those on the loan will be held responsible for payments and share ownership of the home.

These loans don’t require any mortgage insurance or a down payment for the Veteran’s portion, which can be a huge advantage for borrowers. The VA guaranty covers a portion of the outstanding balance if the borrower defaults, which allows more favorable terms and competitive interest rates.

Traditional VA Loan vs Joint VA Loan

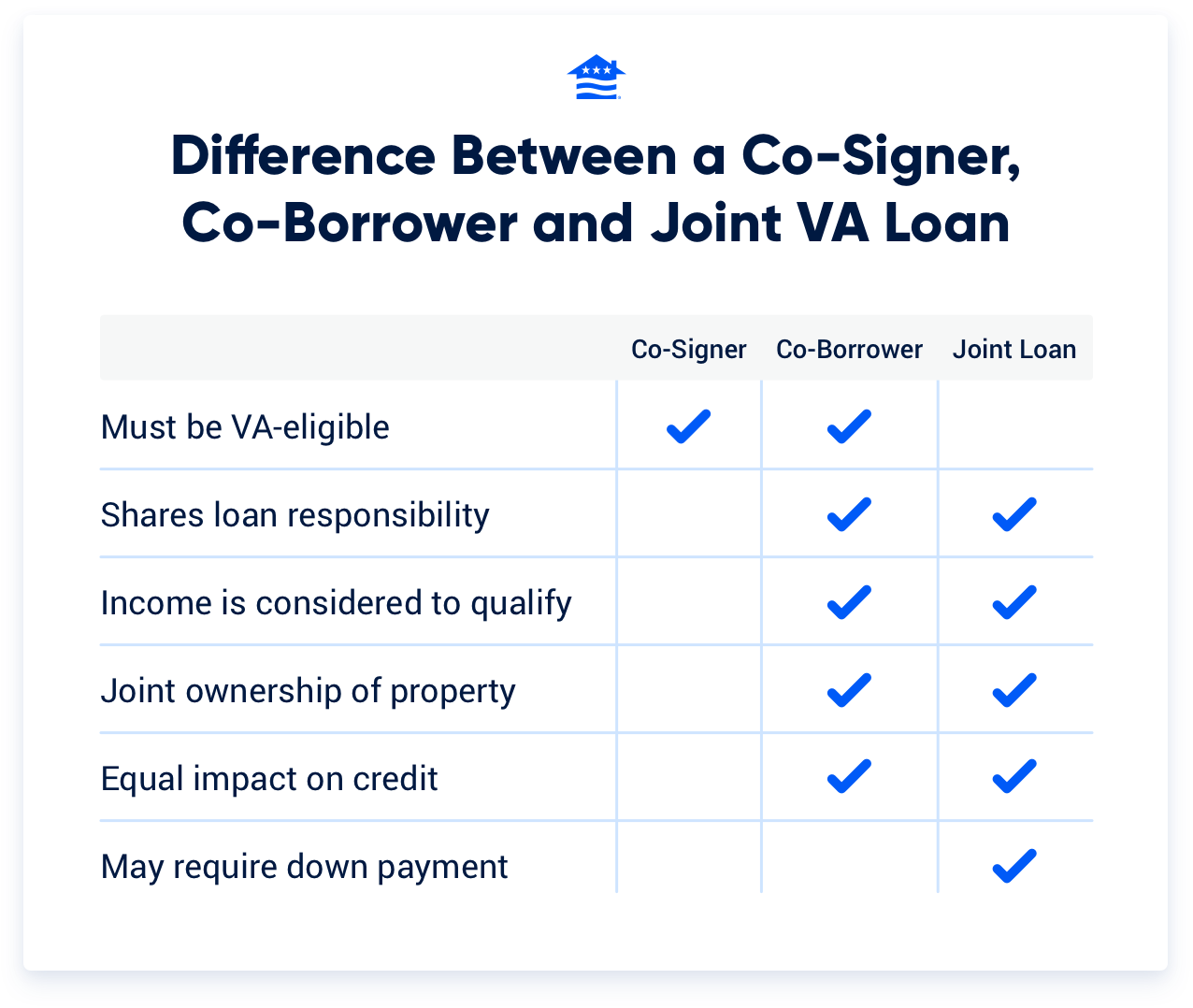

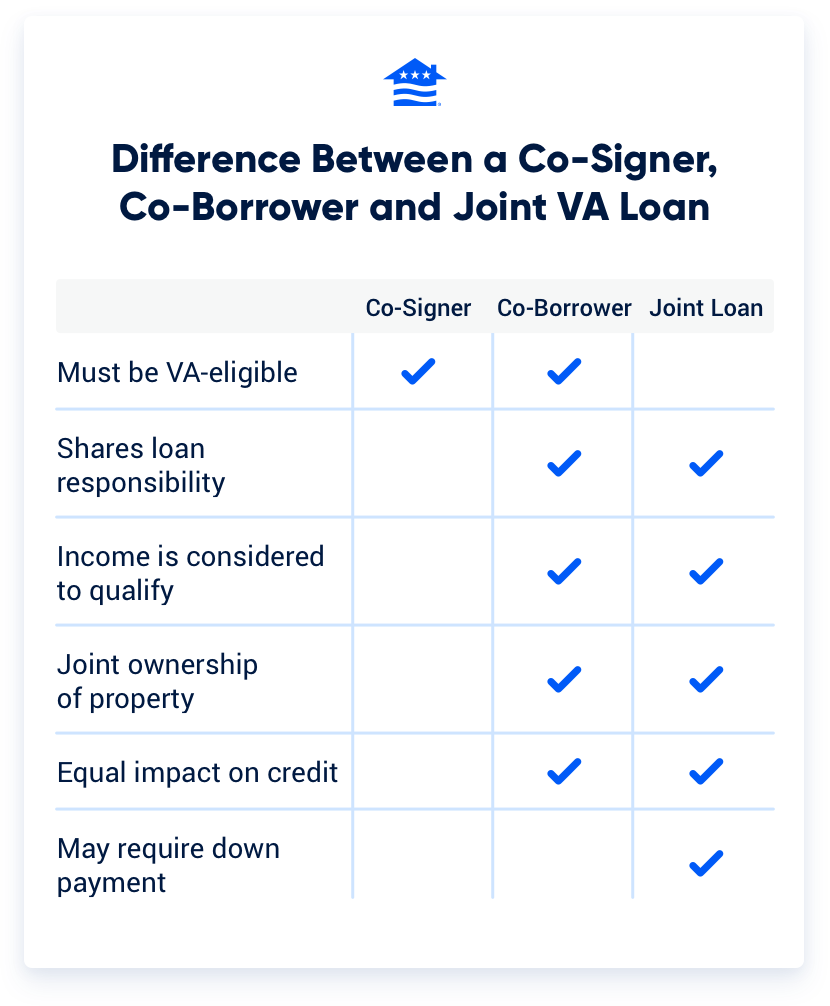

The main difference between a traditional VA loan and a joint VA loan is the involvement and entitlement usage of the borrowers. With a traditional VA loan, the borrower is either a Veteran alone or with their spouse, and the entire loan is covered by the Veteran's entitlement and the VA guarantee.

Applying with a co-borrower on a traditional VA loan can be similar to a joint loan, but the co-borrower must be VA-eligible. VA joint loans allow for non-military borrowers to be on the loan.

Who Can Get a Joint VA Loan?

The VA has certain restrictions on who can be on the loan for it to be considered a joint VA loan. It’s important to understand that VA loans function differently based on the marital status of the borrowers.

A VA loan involving a Veteran and a spouse is usually not treated as a joint loan if the spouse is not a Veteran or a Veteran not using entitlement on the loan. VA loans treat a Veteran and their spouse as one entity, even if only one applicant meets the service requirements. When a Veteran and a non-Veteran borrow together, it is considered a joint VA loan.

Common borrower combinations for a joint VA loan include:

- Veteran and at least one non-Veteran who is not their spouse

- Veteran and one or more Veteran not using their entitlement and not a spouse

- Veteran with their Veteran spouse, both using their entitlement

- Veteran and one or more Veteran, all using their entitlement and not a spouse

Joint VA Loan Requirements

In addition to traditional VA loan requirements, there are joint VA loans guidelines to be aware of:

- Veteran using entitlement must occupy the property as their primary residence

- Down payment may be required for non-military borrowers

- Veteran and any non-spouse borrower must require prior approval

- Veterans must provide a written agreement if they're using unequal entitlement amounts

- Creditworthiness and income of all borrowers on the loan are assessed

- The VA funding fee must still be paid by Veteran using entitlement unless exempt

Answer a few questions below to speak with a specialist about what your military service has earned you.

VA Entitlement and Joint Loans

VA loan entitlement is the amount the Department of Veterans Affairs (VA) guarantees on a VA home loan. The VA will only guarantee the Veteran's portion of the loan, so a down payment might be necessary if there's a non-military borrower who isn't your spouse on the loan.

If two or more VA-eligible borrowers apply together, not every borrower is required to use their entitlement. If only one borrower uses their entitlement, the VA will only guarantee 25% of the portion of the loan covered by the Veteran using entitlement.

If both VA-eligible borrowers want to use their entitlement, that is completely acceptable. However, a written agreement is required if there is unequal entitlement usage between Veterans.

Pros and Cons of Joint VA Loans

| Pros | Cons |

|---|---|

| May qualify easier with multiple | Must pay VA funding fee |

| Only one borrower must be VA-eligible | May require down payment for non-military borrowers |

| Multiple incomes can increase buying power and home budget | May tie up entitlement, making it harder to reuse VA benefits |

When to Use a Joint VA Loan

There are certain instances when a joint VA loan may be your best choice. Let’s take a look at some common scenarios:

- Purchasing with a non-Veteran friend or family member: A Veteran looking to purchase a home with a friend who isn’t a spouse or family member might opt for a joint loan.

- Unmarried couples: A joint VA loan can offer the perfect solution for a Veteran and their unmarried partner to co-purchase a home while leveraging the Veteran's benefits. If a Veteran plans to buy a home with a fiancé who is a non-Veteran and they want to close the loan before getting married, a joint loan would be necessary.

- Combined resources: A Veteran might want to pool resources with a non-Veteran to afford a more expensive property that would be beyond their individual financial reach.

- Purchasing a multifamily home with more than four units: A Veteran co-owning a property with other eligible Veterans can have four residential units, one business unit and an additional unit for each participating Veteran.

- Second VA loan: If a Veteran has already used their entitlement on a home but has some remaining, they might use a joint loan with another Veteran who has full entitlement on a second home.

In each of these cases, it's crucial to understand that the VA will only guarantee the portion of the loan corresponding to the eligible Veteran's entitlement, and non-Veterans on the loan will typically need to make a down payment on their share of the purchase.

Talk to a Veterans United VA loan expert at 573-876-2600 to see if you qualify for a joint VA loan and discuss your options or get started online today.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Feb 19, 2025

Written ByChris Birk

Reviewed ByDon Wilson

Minor content updates and fact checked by underwriter Don Wilson.

Related Posts

-

What is Credit and Why It’s ImportantDiscover why credit matters when buying a house. Learn how a strong score unlocks lower rates, better loans, and more financial freedom.

What is Credit and Why It’s ImportantDiscover why credit matters when buying a house. Learn how a strong score unlocks lower rates, better loans, and more financial freedom. -

Home Inspection for VA Loans: Guidelines and ChecklistLearn about the purpose of a home inspection, common issues and how a home inspection differs from the VA appraisal.

Home Inspection for VA Loans: Guidelines and ChecklistLearn about the purpose of a home inspection, common issues and how a home inspection differs from the VA appraisal.