The Lower-Rate Radar™

Get 24/7 rate monitoring and alerts when big savings are in range. Only from Veterans United.

Start your quote today

Interest rates aren’t forever.

Don’t let today’s rate get between you and buying your next home. Our exclusive Lower-Rate Radar™ starts scanning the moment you close on a home with us and alerts you instantly when a better rate and big savings are available.2

Here’s how the Lower-Rate Radar™ works:

-

Buy your new home with Veterans United.

We’ll help you get the most from your VA loan benefit. VA buyers can tap into the industry’s lowest average fixed rates and buy with $0 down payment.

-

We’ll constantly scan for savings for you.

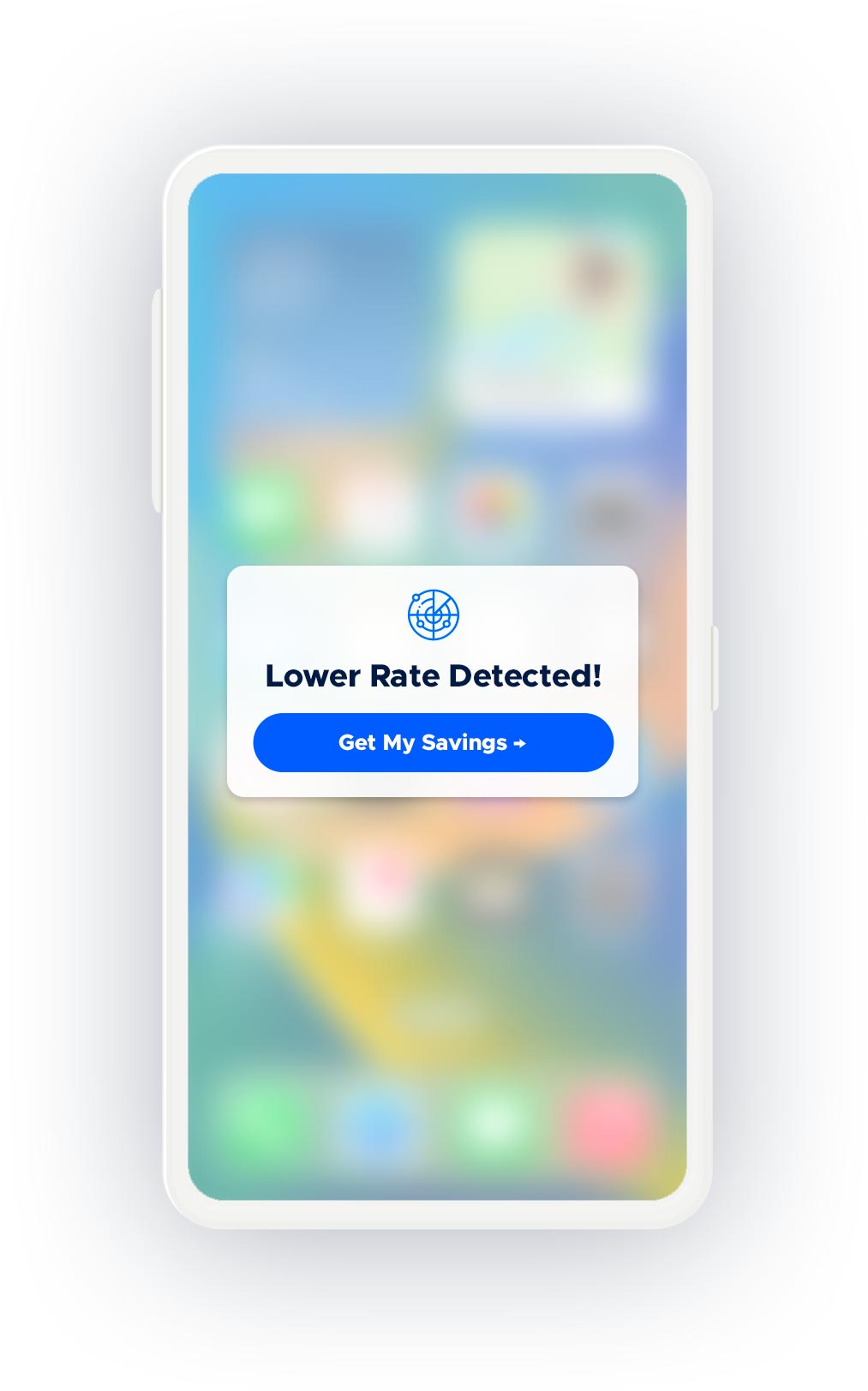

The Lower-Rate Radar™ keeps tracking rates long after you close on your home. Get alerted in MyVeteransUnited® as soon as a lower rate and savings are detected.2

-

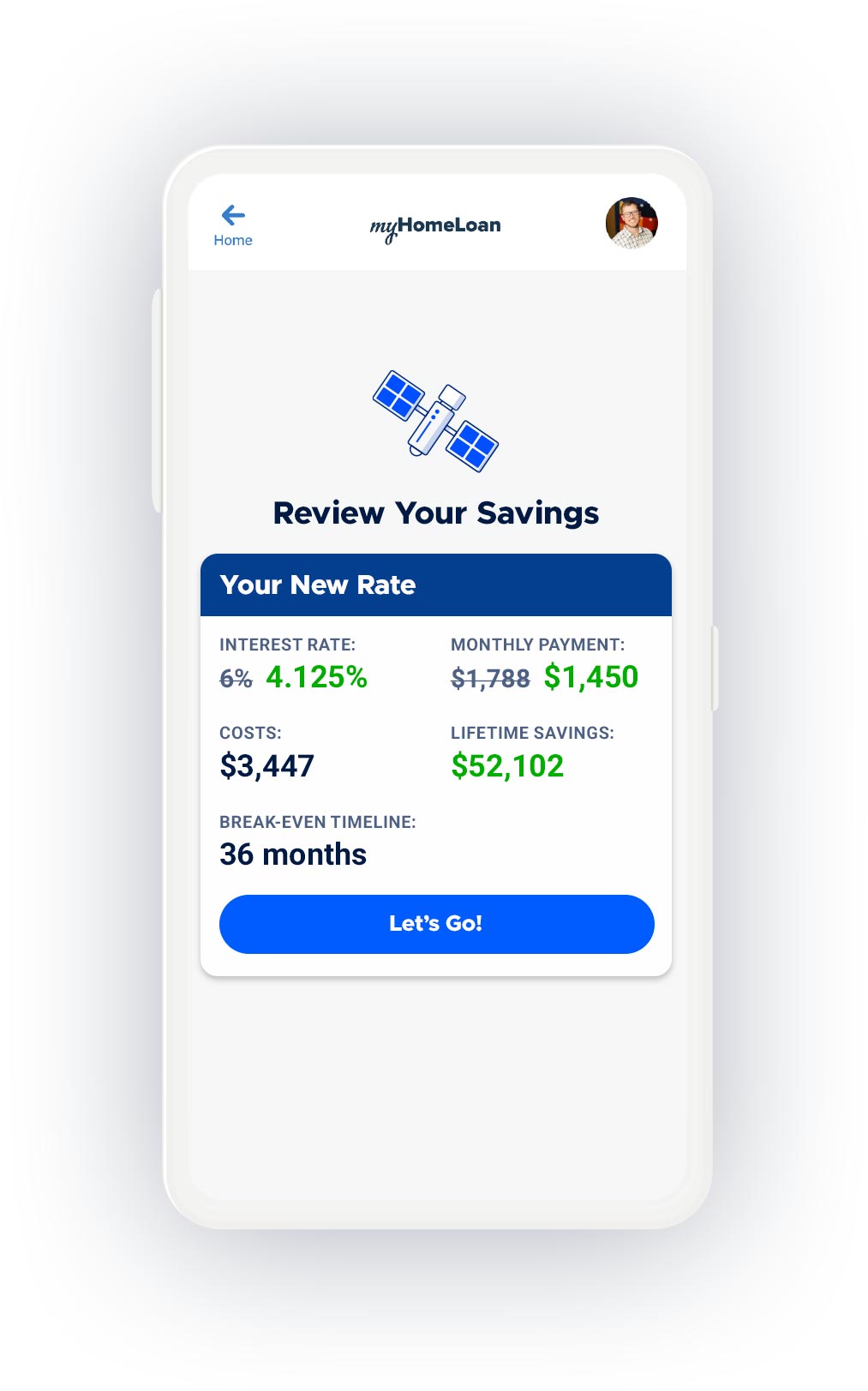

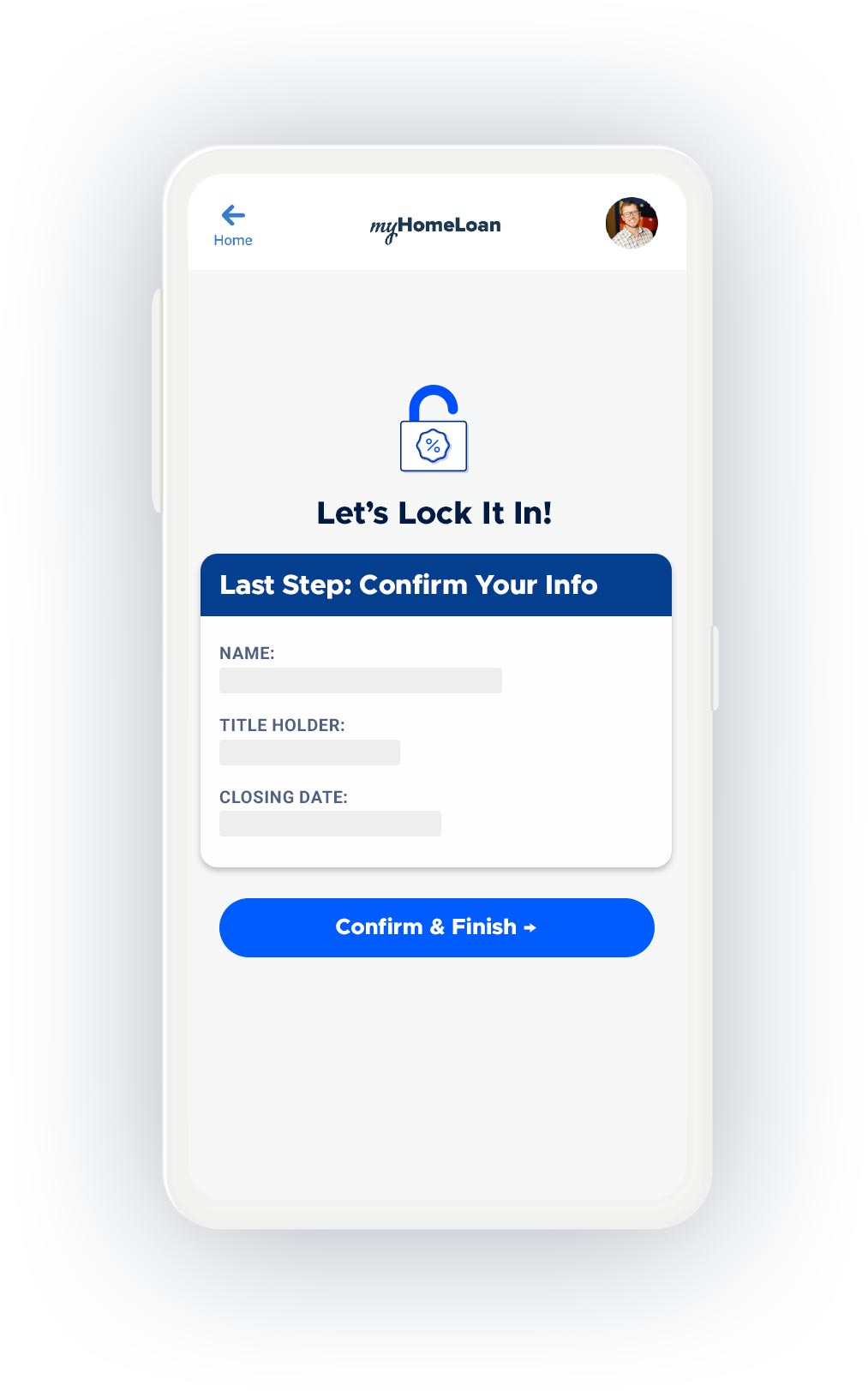

Lock in new lower payments: fast & easy.

Choose instantly from your custom refinance options online or talk it through with your loan team. Lock in your new rate and lower payment fast with discounts exclusive to Veterans United homebuyers.3

Today’s Rates

Scanned on Apr 8th, 06:26 PM CST.

Putting lower rates and big savings at your fingertips.

The Lower-Rate Radar™ taps into the power of the VA Streamline Refinance program, an exclusive benefit for Veterans that can help lower your monthly payment fast with minimal paperwork and meaningful savings.

We never stop scanning for savings.

Buy your new home with the peace of mind that we’ll never stop searching for lower rates and bigger savings after you close.2 Only with the Lower-Rate Radar™ from Veterans United.

Start your quote today1 Average Veterans United Home Loans VA Streamline Refinance customer mortgage payment reduction 1/1/2021 — 1/1/2023.

2 Subject to capacity and availability. Some restrictions may apply. Requires a current VA Loan with at least 7 completed monthly payments. In certain scenarios, more commonly with cash-out refinance loans and non-VA refinance products, a consumer’s total finance charges may be higher over the life of the loan with a refinance. Talk with your loan team about your specific situation and benefits.

3 Discounts may include further rate reductions and/or waived or reduced origination fees. Some restrictions may apply. In certain scenarios, more commonly with cash-out refinance loans and non-VA refinance products, a consumer’s total finance charges may be higher over the life of the loan with a refinance. Talk with your loan team about your specific situation and benefits.

All screen images simulated.